Our Solutions

AllLife offers Life and Disability Insurance products that gives you reliable Life Cover with flexible options, and financial protection for your loved ones.

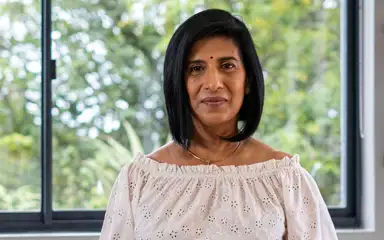

Real people, real stories

Real stories from our clients.

Let us give you a free quote in minutes

Complete our quote form to get a call from one of our agents and discover Life Cover up to R10 million. Enjoy affordable premiums, immediate cover, and simple underwriting. Don't miss out on securing your future with ease and confidence.

Get Your FREE Quote

Complete the form and we will phone you.

Terms and conditions apply